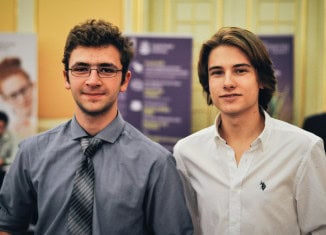

“This is probably the first environment I’ve ever worked in where I can be fully myself,” said Matthew Stewart, a senior underwriter with PeopleFund. “Banking is a good old boys network, and you’ve got bankers who are older and more conservative. I could not be out, openly, other than to my coworkers who were friends. [PeopleFund] is a great place to work…it’s very open. It’s the only place I’ve felt 100 percent comfortable with who I am, and that I don’t have to hide something.”

Stewart made the move to the organization about a year ago after 10 years in banking, an industry known for having a conservative vibe. He went on to say that not only is it nice to work in an environment that actually tries to help people get loans, it’s more enjoyable going to a workplace where he doesn’t have to hide who he is.

In the banking industry he felt guarded and didn’t feel like he could be fully out, which is in contrast to PeopleFund’s environment. The organization’s nondiscrimination policy extends to its clients, too.

One of its clients, Jake Gonzales, starting as a UT student who developed his talents into what is now a thriving professional career, founded and led political activism groups. He parlayed his expertise with Microsoft Excel into a full-time job and most recently launched a management, marketing and strategy firm. When it came time to get a loan for this latest venture, Lone Star Diva & Co., PeopleFund leaped at the opportunity to help.

Gonzales said that working with PeopleFund has been an open, straightforward experience focused entirely on the business and PeopleFund’s role in it. The organization has been supportive and asked questions about the business’s future that forced him to create a stronger business plan.

What PeopleFund hasn’t focused on, to Gonzales’ relief, is the fact that he identifies as a transgender individual. “They didn’t seem fazed by who I was; they just wanted to know what I was doing and how they could help,” he said. Lone Star Diva & Co. has a four-year loan that closed last March.

The kind of interaction Gonzales has had with PeopleFund is typical of all PeopleFund’s transactions, said Gary Lindner, president and CEO of the organization.

“We have a broad and passionate nondiscriminatory practice, and we enjoy helping small businesses outside the financial mainstream,” he continued. “They have the ability and the desire, but they haven’t been given the opportunity.”

PeopleFund provides small businesses and nonprofits access to capital, education and resources to help them develop into healthy organizations or businesses. It provides small business loans, but it also hosts educational workshops and provides mentorship for clients.

Most importantly, said chair emeritus Eugene Sepulveda, PeopleFund helps entrepreneurs create jobs in locales of low and moderate income. And that translates into those entrepreneurs putting food on the table, sending their kids to college and saving for retirement.

“We bankroll those with ambition, a viable business model and who are creating jobs in low- and moderate-income communities but who don’t quite qualify for commercial banking. It might be because of soft collateral values, not yet (having) three years op- erating history or some other structural deficit that doesn’t fit the small business, credit-scoring models of most banks,” Sepulveda said. “We take higher risks and we help entrepreneurs generate high reward in their communities. We expect to be repaid and we usually are. Sometime it takes a little extra love and handholding, but the business model is proven sustainable.”

Tighter capital markets, higher barriers to entry and tougher competition in the marketplace are all factors posing challenges for small businesses, he added.

“PeopleFund doesn’t only offer financial capital; it provides intellectual capital,” Sepulveda continued. The organization’s board and staff quickly realized that many of their clients didn’t grow up with lawyers, bankers, accountants, business executives, or marketing experts in their circle of friends.

The bulk of the money that PeopleFund lends goes toward organizations and businesses owned by women and minorities. PeopleFund also considers more than the numbers when it partners with a client, examining the social impact a client will have on the community.

Both Stewart and Sepulveda said PeopleFund doesn’t have a specific outreach effort, perse, to the LGBT community. While the organization certainly has LGBT clients, it is interested in their business model, not their sexuality.

But, Stewart said he’s hopeful that the organization could reach out to the LGBT community in the future. Sepulveda, who met his partner when PeopleFund’s founder and former CEO Margo Weisz set them up, said, “We love pink dollars as much as green dollars. We’ll try to help you create both!”

PeopleFund

• 75 percent of PeopleFund loans go to economically disadvantaged, minority- or woman-owned businesses.

• Approximately 30 percent of PeopleFund clients are in the education and family support industries.

• $25 million has been loaned since PeopleFund launched in 1994.

• 400 loans have been made since its launch.